Wall Street Sees 133% Upside For This Penny Stock

In 2023, artificial intelligence (AI) has proven to be a boon for technology companies. However, it is not just tech firms that can benefit from leveraging AI tech. To capitalize on this burgeoning market, many other industries have incorporated AI into their offerings.

One such company is fleet management software company PowerFleet (PWFL), whose shares have gained just 5.9% year-to-date, compared to the S&P 500 Index’s ($SPX) gain of 24%. Nonetheless, Wall Street expects this penny stock to more than double over the next 12 months.

Penny stocks can be attractive because of their low prices, but they can also carry significant risks. As a result, understanding the business and the company's growth prospects is critical.

PowerFleet specializes in making vehicles and equipment smarter through advanced technology, IoT (Internet of Things), and AI-driven analytics. The company uses technology to assist other businesses in tracking, managing, and optimizing their fleets. Whether it's trucks, cars, forklifts, or other machinery, PowerFleet's solutions help businesses keep an eye on their assets, improve safety, and run operations more efficiently.

Over the next year, Wall Street has high expectations from the company - possibly due to its improving financials, strategic merger, and how well it can leverage AI to enhance its fleet management solutions in the near future.

PowerFleet’s Strategic Acquisition Could Boost Fundamentals

Much of Wall Street’s recent optimism appears to stem from PowerFleet's latest merger announcement. By combining with MiX Telematics Limited, PowerFleet intends to establish the “largest mobile asset Internet of Things (IoT) Software-as-a-Service (SaaS) providers in the world" under the PowerFleet name.

By the first quarter of 2024, the deal will likely close. Following completion, combined company revenue is anticipated to reach $279 million. In addition, the management reports that the combined company will generate "$39 million of adjusted EBITDA for the trailing twelve-month period and $210 million in recurring high-margin SaaS revenue." Additionally, the merger will boost PowerFleet's total subscriber base to about 1.7 million, with annual EBITDA (earnings before interest, tax, depreciation, and amortization) expansion in the first two years.

As of the third quarter, PowerFleet’s subscriber count stood at 707,342, an increase of 8% year-over-year. Total revenue of $34.2 million was in line with the year-ago quarter.

The company is not profitable yet, with net losses in the quarter rising to $4.9 million from $3.5 million in the year-ago quarter. Adjusted EBITDA of $2 million increased three-fold sequentially, but dipped from the prior-year quarter.

What Do Analysts Say About PowerFleet Stock?

Talking about the merger, Canaccord Genuity analyst Michael Walkley believes the expanded customer base post-merger will help PowerFleet generate substantial shareholder value. The analyst is also optimistic about PowerFleet’s Unity software platform's ability to drive profit margins in the future. Walkley has a “buy” rating with a target price of $6.00 for PWFL.

I, too, believe that this merger has the potential to propel the company to profitability in the long run. Keeping the merger in mind, management presented the company's goals for 2024 and 2025 during its investor day in November. The following are the company's estimates:

- 2023: Revenue of $285 million with $40 million in adjusted EBITDA

- 2024: Revenue of $300 million with $60 million in adjusted EBITDA

- 2025: Revenue of $340 million with $100 million in adjusted EBITDA

Furthermore, management expects the subscriber count to increase to $2.3 million in 2025, with more than $3 million as the long-term target. Walkley believes that PowerFleet's 2024 and 2025 targets are achievable. By comparison, the consensus revenue estimate stands at $133 million and $145 million for 2023 and 2024, respectively.

While PowerFleet's revenue hasn't increased dramatically, it has steadily increased from $53 million in 2018 to $135 million in 2022. Management also anticipates that this merger will open doors of opportunity in new markets where the company has little to no presence. PowerFleet has also kept its balance sheet stable for the time being, with $19.6 million in cash and cash equivalents and $9.6 million in long-term debt at the end of the third quarter.

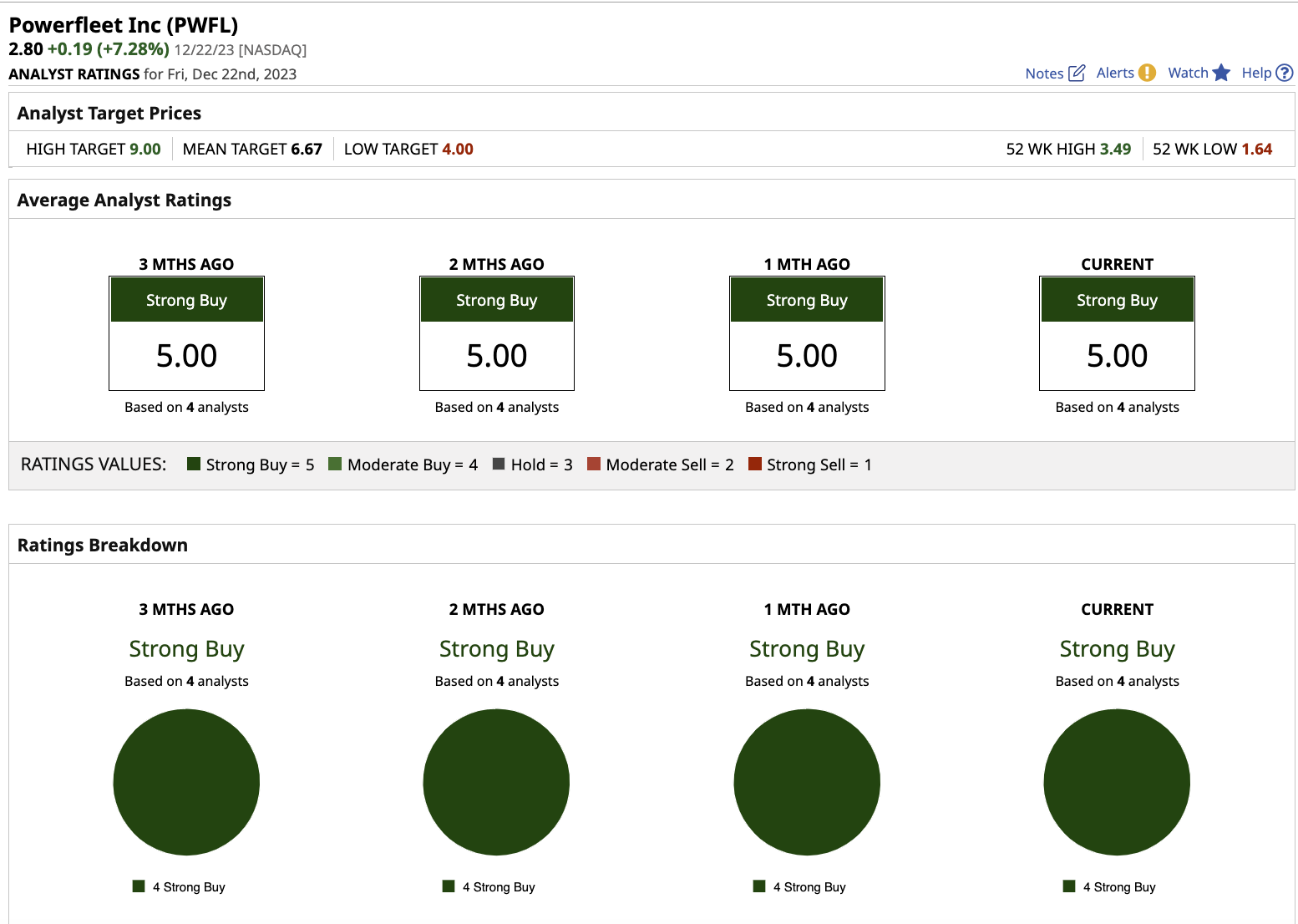

Out of the four analysts that cover PowerFleet stock, all of them rate it a “strong buy.” The average target price for PWFL stock is $6.67, which is 133% higher than current levels. Furthermore, its high target price of $9 implies a potential upside of 214% over the next 12 months.

The Bottom Line on PowerFleet

PowerFleet's relentless pursuit of innovation, along with its commitment to customer satisfaction and sustainability, solidifies its position as a key player in the fleet management landscape.

Penny stocks typically carry a high level of risk and are only sometimes a worthwhile investment. However, PowerFleet’s strategic merger and strengthening fundamentals present a compelling case for this penny stock. With the help of this merger, the company will be able to capitalize on new opportunities and expand its market presence, resulting in long-term profitability. Therefore, I share Wall Street’s enthusiasm for PowerFleet’s stock.

That said, note that investing in penny stocks requires thorough due diligence and a high-risk tolerance. Since PowerFleet is still a growing company, it would be a good idea to diversify your portfolio with some more stable stocks.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.