AMD Is Making a Big Bet on Quantum Computing. Should You Buy AMD Stock Here?

Quantum computing has quickly shifted from futuristic theory to one of the most closely watched frontiers in technology. While the space is still early-stage, investors are increasingly paying attention as partnerships and breakthroughs begin to hint at real-world applications. Much like artificial intelligence (AI) a few years ago, quantum could redefine computing over the next decade.

One of the newest entrants making a serious move is Advanced Micro Devices (AMD). Known for its CPUs and GPUs that rival Intel (INTC) and Nvidia (NVDA), AMD is now teaming up with IBM (IBM) to explore hybrid quantum-classical architectures. The goal Over the next five years, AMD will be partnering with IBM to try and achieve its quantum computing goals, to build scalable, open-source platforms.

For investors, this collaboration raises the question: Could AMD’s quantum bet unlock its next major growth catalyst?

About AMD Stock

Based in California, Advanced Micro Devices is a leading semiconductor company specializing in high-performance computing, graphics, and visualization technologies. The firm designs CPUs, GPUs, and adaptive processors that power data centers, PCs, gaming consoles, and embedded systems, driving innovation across artificial intelligence, cloud, and edge computing markets.

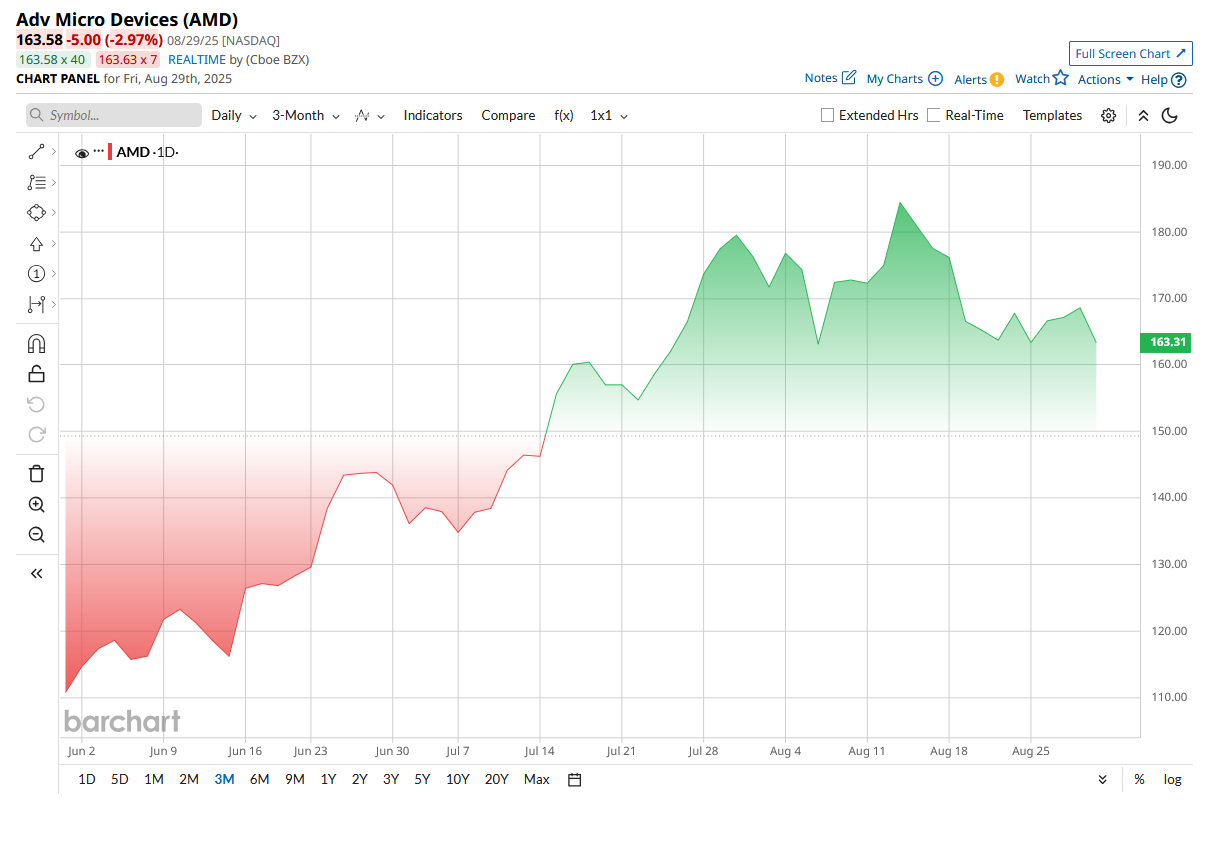

Valued at $271 billion by market cap, shares of AMD had a stellar year with the stock surging more than 30% year-to-date (YTD), making it one of the top sector performers as strong demand for AI-driven chips and data center products fueled investor confidence.

However, this strong performance comes with a cost. After the bull run, the stock reached elevated levels. AMD trades at a P/E ratio of 43x, compared to the sector median of 24x. However, its forward PEG of 1.39 indicates a discount of 26% compared to the sector, suggesting some level of underpricing.

Advanced Micro Devices Beats Q2 Earnings Estimates

AMD just delivered a strong Q2 earnings, showing its momentum in both AI and quantum bets. Revenue hit a record $7.7 billion, up 32% year-over-year (YoY), while free cash flow jumped to $1.18 billion from $727 million last year. Earnings per share came in at $0.48, matching expectations, though margins were pressured by an $800 million inventory write-down tied to U.S. export restrictions. Excluding that, gross margin would’ve been closer to 54%. AMD closed the quarter with $4.44 billion in cash plus another $1.43 billion in short-term investments, giving it plenty of financial flexibility.

On the product side, both EPYC server chips and Ryzen PC CPUs hit record sales, while CEO Lisa Su highlighted the coming ramp of the new Instinct MI350 GPUs as a major growth driver for the second half of the year.

Looking forward, AMD guided Q3 revenue to around $8.7 billion, up about 28% YoY, with analysts expecting full-year 2025 growth of roughly 24%. In short, despite some export-related hiccups, AMD’s AI and data center momentum is fueling strong results and an upbeat outlook.

What Do Analysts Think About AMD Stock?

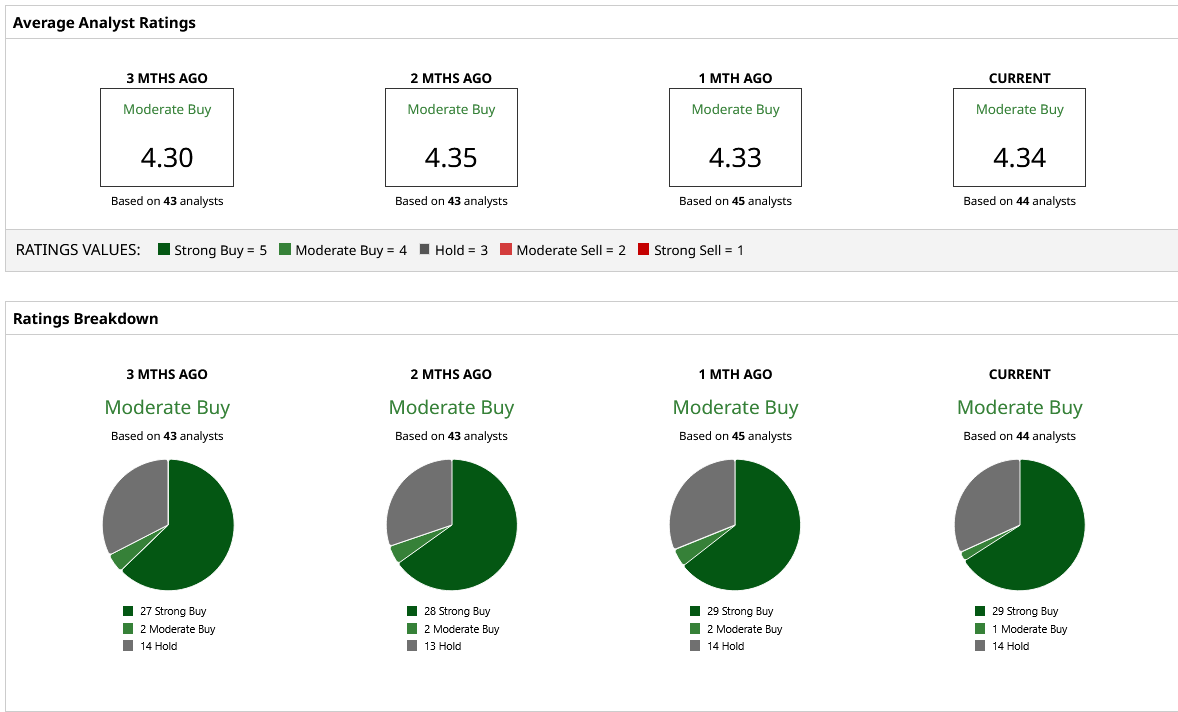

This month, several Wall Street firms revised their price targets for AMD. UBS analyst Timothy Arcuri lifted his price target to $210, citing robust AI demand and a clearer path for approvals of AMD’s MI308 accelerator sales to China.

Meanwhile, J.P. Morgan nudged its target to $180 while keeping a “Neutral” rating. The firm highlighted AMD’s solid AI tailwinds, but advised caution given the uncertainties tied to China-related revenues. J.P. Morgan emphasized the importance of management’s forward guidance and customer adoption trends.

Overall, AMD remains well-positioned in the eyes of Wall Street. The stock carries a consensus “Moderate Buy” rating, with an average 12-month price target of $188. That implies a potential upside of roughly 12% from current levels, reinforcing AMD as a healthy pick among analysts.

Should You Buy AMD Stock?

AMD has arguably never been more central to computing’s future: it dominates in high-performance CPUs for cloud/enterprise, is ramping new AI accelerators, and is now linking with IBM on quantum research. These are all long-term positives. In the near term, Q3 guidance and AI GPU ramps look solid. However, the stock already trades near lofty levels. With such a high price-to-earnings (P/E), expectations are lofty, any miss on margins or macro weakness could sting.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.