Dear Nvidia Stock Fans, Mark Your Calendars for September 17

/NVIDIA%20Corp%20logo%20on%20phone%20and%20AI%20chip-by%20Below%20the%20Sky%20via%20Shutterstock.jpg)

Sept. 17 could be a big day for Nvidia (NVDA) shareholders, as CEO Jensen Huang will attend a state banquet at Windsor Castle during President Trump's second UK state visit.

Huang won't be dining alone. He'll sit alongside some serious heavy hitters: OpenAI's Sam Altman, BlackRock's (BLK) Larry Fink, and Blackstone's Stephen Schwarzman. Apple's (AAPL) Tim Cook has also received an invitation and may attend the big-ticket event. When you see that guest list, you know something's brewing.

Nvidia is now worth over $4 trillion, making it the world's most valuable public company. Sources expect major corporate deals and U.K. investment announcements to flow from Trump's visit. Moreover, partnerships between the U.S. and UK on AI and nuclear power are on the table.

Nvidia dominates the AI chip market and is positioned to benefit from any new agreements on AI development or tech sharing between these two countries.

Is NVDA Stock a Good Buy Right Now?

Despite its massive size, Nvidia continues to grow at a steady pace. In fiscal Q2 of 2026 (ended in July), the chipmaker reported record sales of $46.7 billion. Nvidia's transition to its Blackwell platform indicates a focus on execution. The GB300 ramp has been seamless, with production now at 1,000 racks per week and continuing to accelerate through Q3. Blackwell achieves a 10x improvement in energy efficiency compared to the previous Hopper generation, a crucial advantage for data centers facing power constraints.

Early customers, such as CoreWeave (CRWV), report 10 times more inference performance on reasoning models compared to H100 chips. Management's bold claim of $3-4 trillion in AI infrastructure spending by the end of the decade reflects the scale of transformation underway.

The shift toward reasoning and agentic AI, where models research, plan, and utilize tools rather than simply responding to prompts, requires 100 to 1,000 times more computing power. This evolution opens new markets in enterprise AI, robotics, and industrial automation.

The H20 situation in China remains lucrative. Nvidia estimates a $50 billion annual opportunity in China if restrictions ease, with potential Q3 revenue of $2 billion to $5 billion, depending on geopolitical developments. Management continues to advocate for Blackwell approval in China, viewing it as essential for maintaining American AI leadership globally.

While ASIC competition exists, Nvidia's advantages appear durable. The company's full-stack approach, which spans six different chip types just for the Rubin platform, creates complexity barriers competitors struggle to match. Annual product cadences ensure customers stay current while maximizing revenue per watt of power consumed.

With networking revenue hitting $7.3 billion (up 98% year-over-year) and a strong recovery in gaming sales, diversification beyond data centers provides stability. The company's ability to translate energy efficiency gains directly into customer revenue creates a compelling value proposition in power-constrained environments.

However, investors should monitor competition from custom silicon and potential demand normalization as the initial AI infrastructure buildout matures.

Is NVDA Stock Still Undervalued?

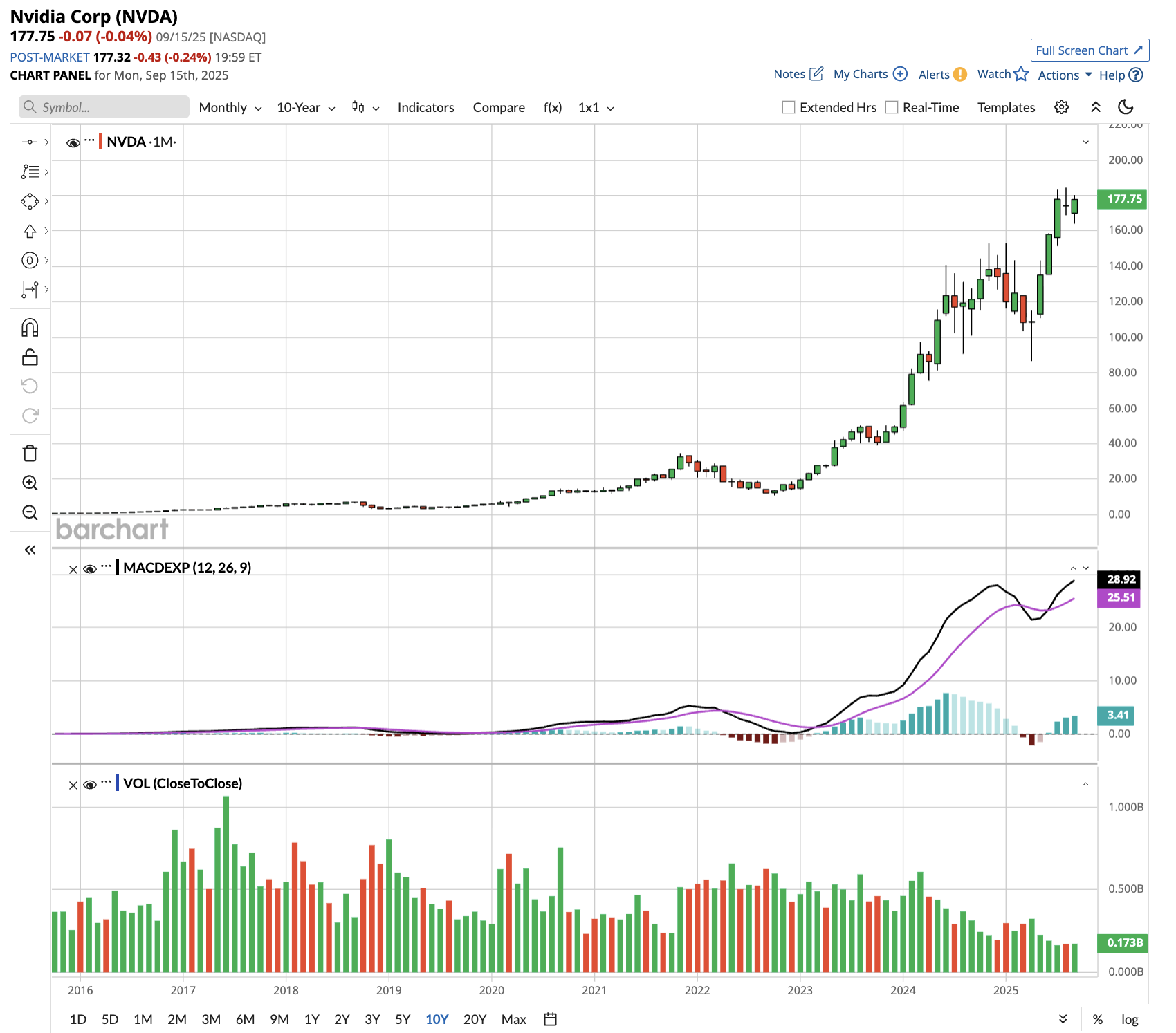

Due to its first-mover advantage, NVDA stock has returned 1,320% in the last three years and a staggering 28,700% in the past decade. It means that a $1,000 investment in NVDA stock in September 2015 would be worth nearly $287,000 today.

However, Nvidia’s growth story is far from over, given that sales are forecast to increase from $130.5 billion in fiscal 2025 to $383 billion in fiscal 2030. Its adjusted earnings are forecast to expand from $2.99 per share to $8.92 per share in this period.

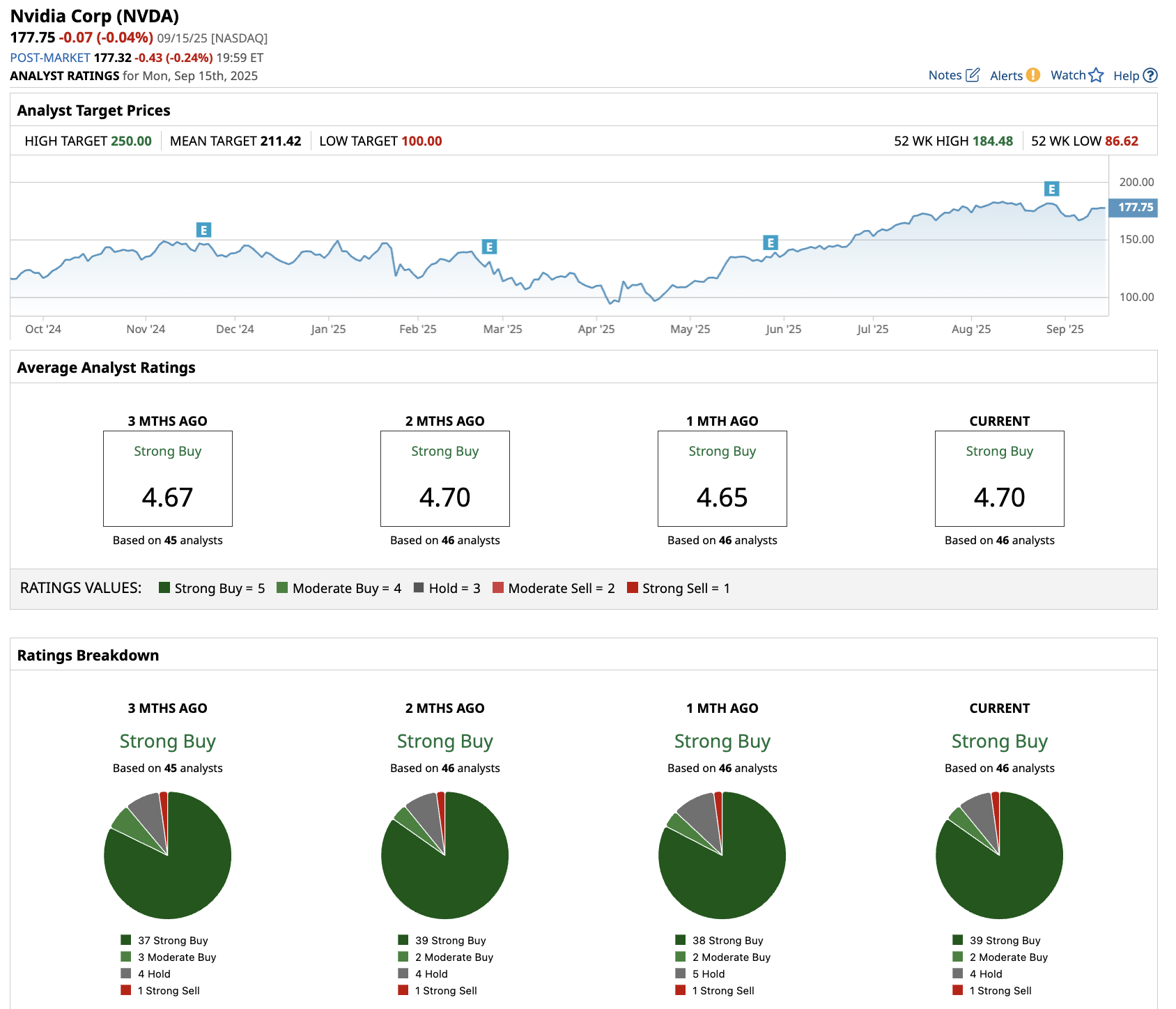

Out of the 46 analysts covering NVDA stock, 39 recommend “Strong Buy,” two recommend “Moderate Buy,” four recommend “Hold,” and one recommends “Strong Sell.” The average Nvidia stock price target is $211.40, which is above the current price of $178.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.