5 ‘Strong Buy’ Stocks That Could Dominate the AI Economy in the Next 10 Years

/AI%20(artificial%20intelligence)/AI%20engineer%20working%20on%20laptop%20by%20ART%20STOCK%20CREATIVE%20via%20Shutterstock.jpg)

Artificial intelligence (AI) is rapidly reshaping every corner of the global economy. As this transformation accelerates, a handful of companies are poised to lead the way and reap enormous long-term benefits. Here are five stocks that could rule the AI economy in the coming decade.

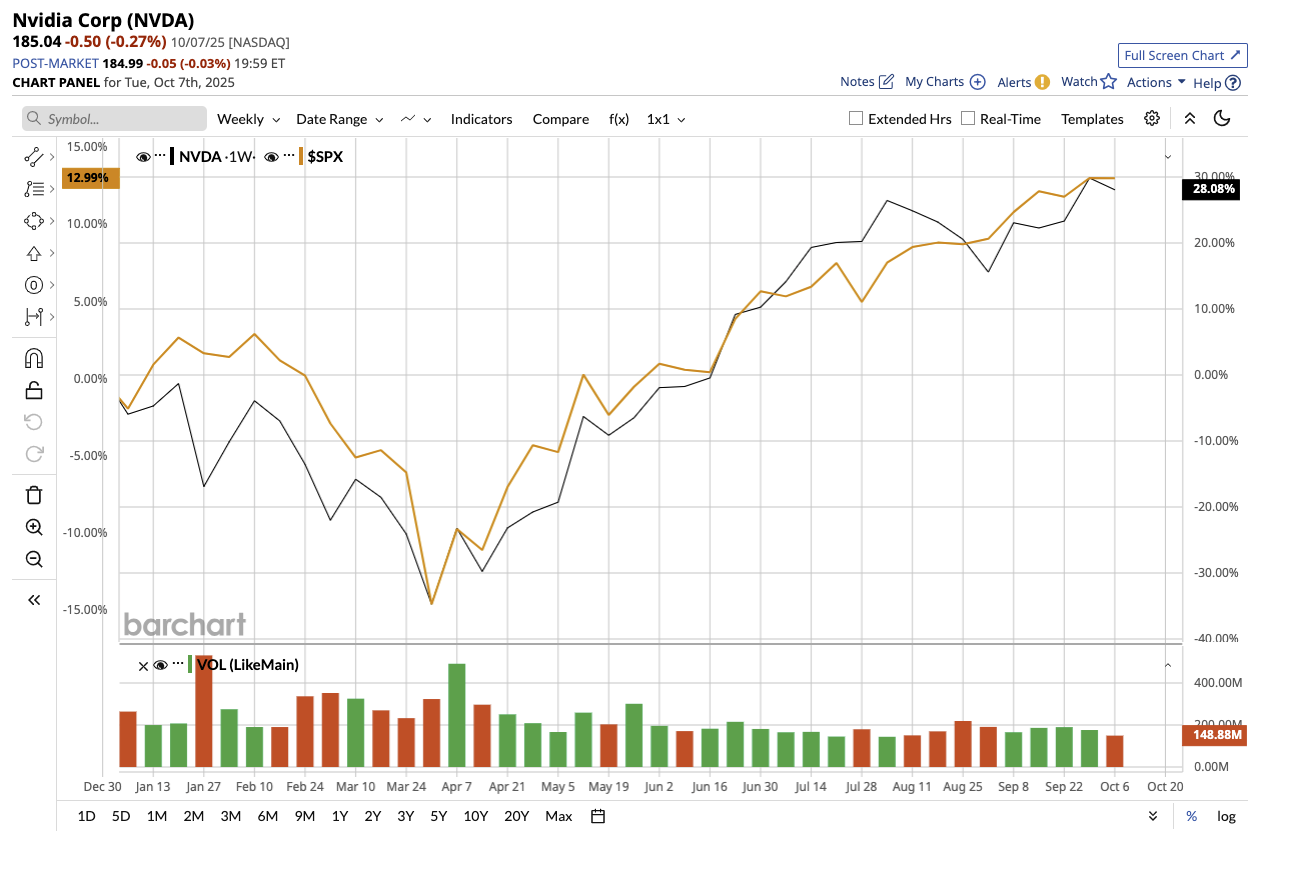

Stock #1: Nvidia

Valued at $4.6 trillion, chip giant Nvidia (NVDA) continues to prove why it sits at the heart of the global AI boom. Nvidia’s stock has gained 43.5% year-to-date, compared to the broader market gain of 14.3%.

In its fiscal 2026 second quarter, the company delivered a staggering $46.7 billion in revenue, with data center sales soaring 56% year over year, emphasizing its dominance in AI computing. But Nvidia’s success extends far beyond semiconductors. It has created a formidable AI ecosystem with software platforms such as CUDA and Nvidia AI Enterprise, which are currently used by millions of developers globally. Its innovation pace, massive lead in AI infrastructure, and deep partnerships give it an unrivaled competitive moat that’s nearly impossible to replicate.

Overall, Nvidia stock is a “Strong Buy” on Wall Street. Out of the 47 analysts that cover the stock, 40 have a “Strong Buy” recommendation, with two “Moderate Buy” ratings, four “Hold” ratings, and one “Strong Sell” rating. The average target price for Nvidia stock is $217.14, which implies potential upside of 13% over the next 12 months. The high price estimate of $275 implies the stock can rally as much as 43% from current levels.

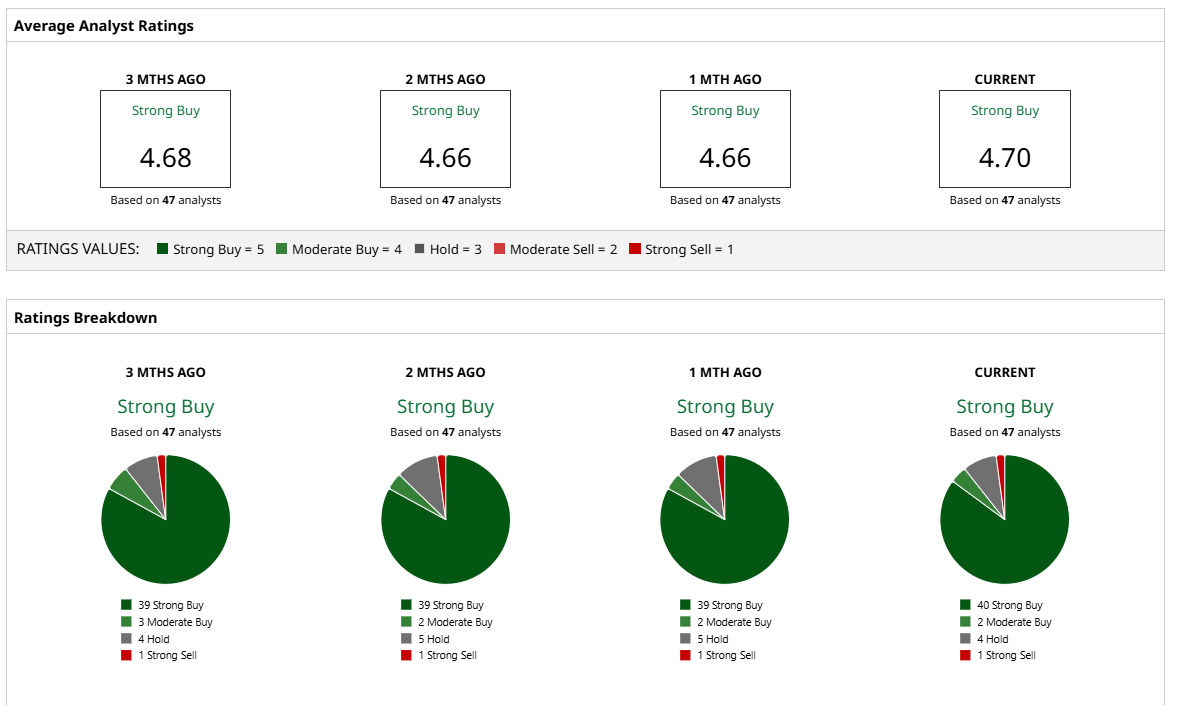

Stock #2: Microsoft

Valued at $3.9 trillion, legacy tech player Microsoft (MSFT) has firmly positioned itself at the center of the AI revolution. Microsoft stock is up 23.3% year-to-date.

In fiscal 2025, revenue surged 15% year over year to $281 billion, driven by record demand for cloud and AI services. Microsoft’s scale is unparalleled, with over 400 new data centers across 70 geographies and enormous investments in GPU and CPU servers, showcasing its ambition to lead the AI-driven future. CEO Satya Nadella views AI as a generational platform change that is altering all aspects of Microsoft’s business, from Azure and Microsoft 365 to security and gaming. With a $368 billion backlog and double-digit growth predicted through fiscal 2026 and beyond, Microsoft appears to be poised for long-term dominance.

Overall, Wall Street has assigned Microsoft stock a “Strong Buy” rating. Of the 48 analysts covering MSFT stock, 40 have a “Strong Buy” recommendation, five suggest a “Moderate Buy,” and three rate it a “Hold.” The average price target of $630.49 implies the stock has upside potential of 21% over current levels. Plus, the Street-high price estimate of $680 suggests the stock can rally over 31% over the next 12 months.

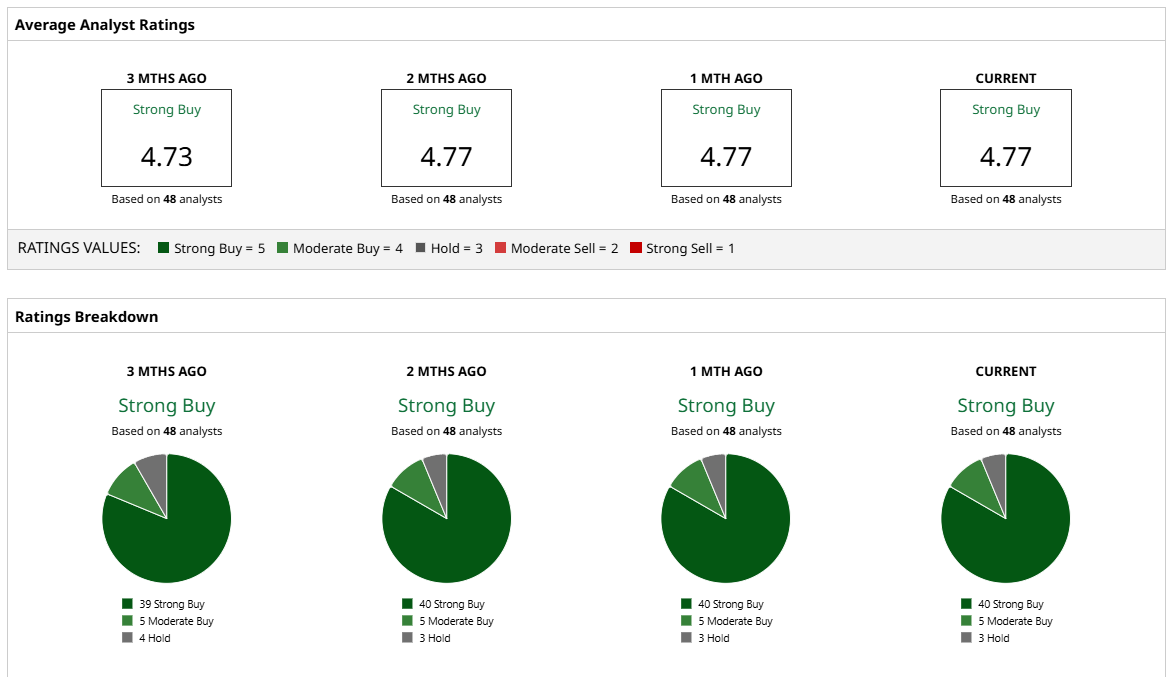

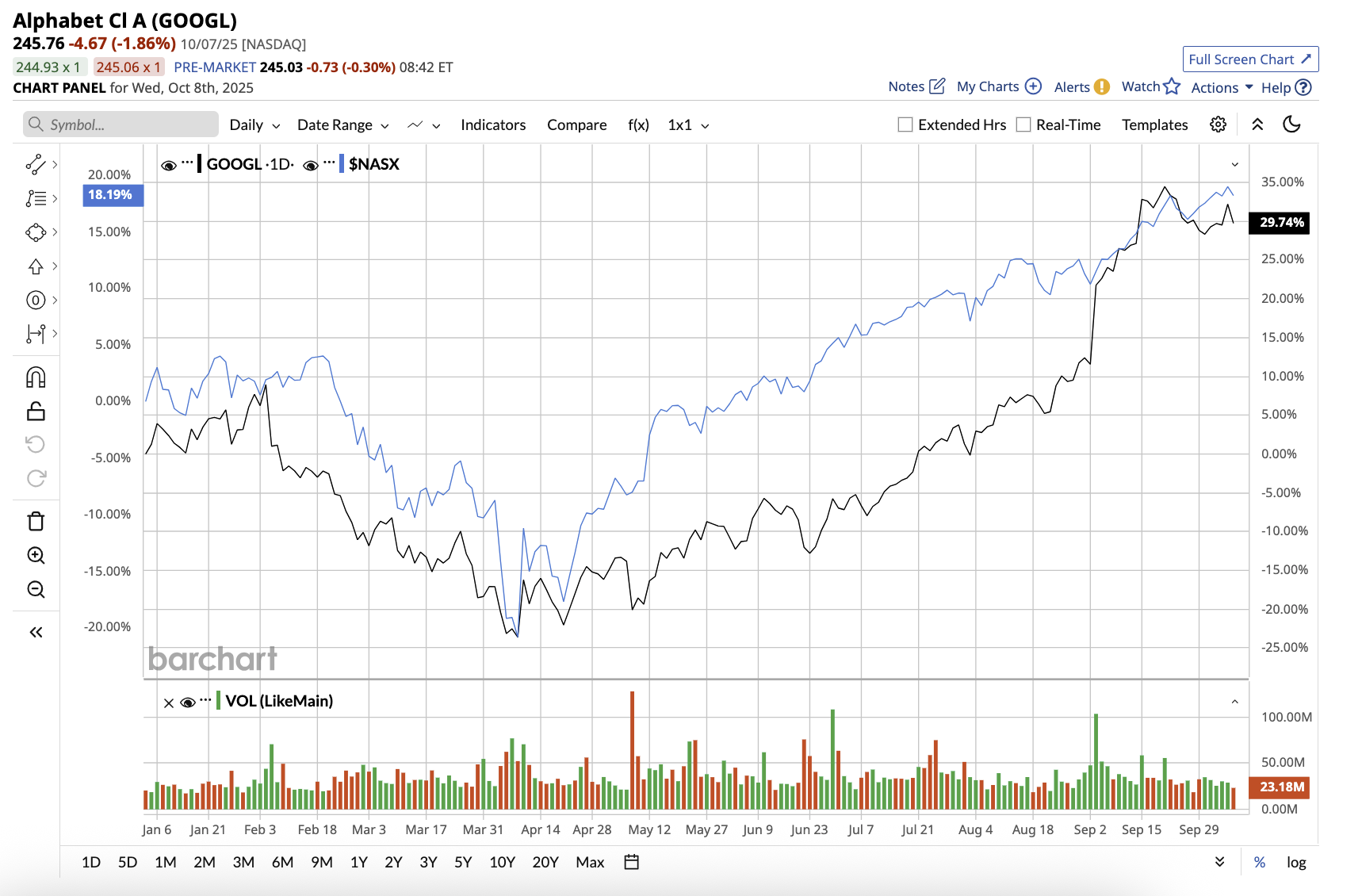

Stock #3: Alphabet

Valued at $2.98 trillion, Alphabet (GOOGL), Google’s parent company, is proving that AI is not only boosting, but also redefining its business. In the second quarter, revenue surged 14% year-over-year to $96.4 billion, owing to strong performance in Google Services and Cloud. Net income increased 19% to $28.2 billion, demonstrating how deeply AI is integrated into Alphabet’s growth engine.

GOOGL stock has climbed 27.1% year-to-date, outperforming the tech-led Nasdaq Composite Index ($NASX).

AI has transformed Google Search, which now powers Gemini 2.5 for more than 2 billion users globally. Google Cloud, another critical component of Alphabet’s AI ecosystem, generated $13.6 billion in revenue, up 32% year over year, with operating margins nearly doubling to 20.7%. With $95 billion in cash reserves and significant AI-driven growth in Search, Cloud, and YouTube, Alphabet is uniquely positioned to dominate the AI economy over the next decade.

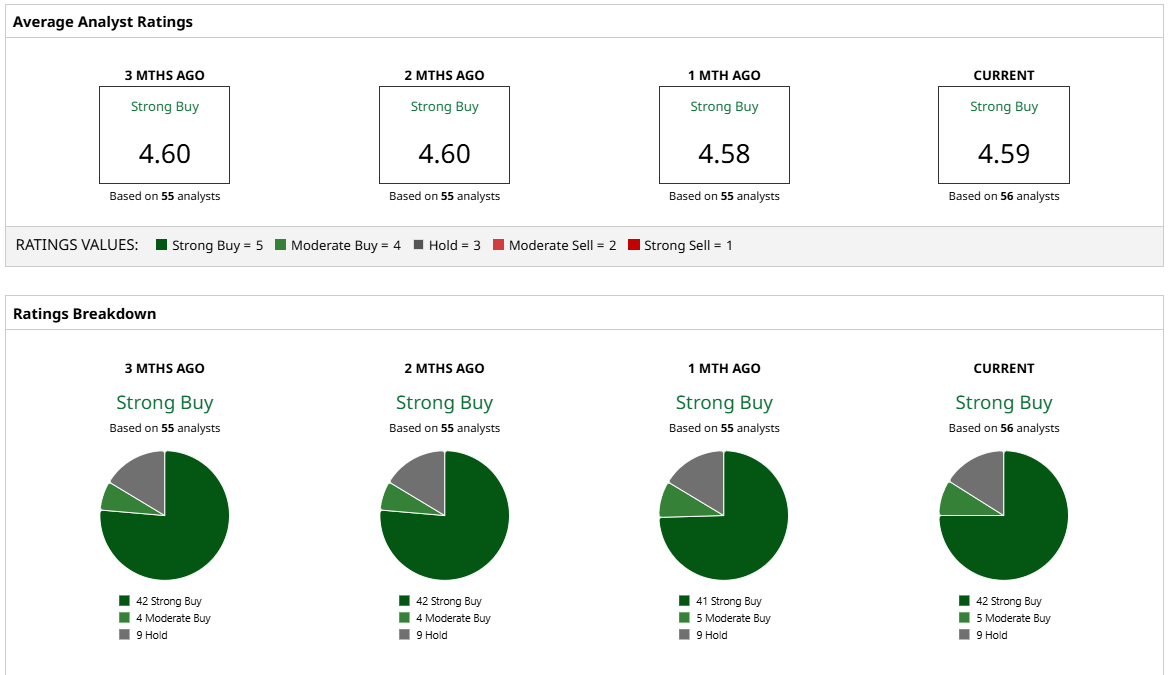

Overall, on Wall Street, GOOGL stock is a “Strong Buy.” Of the 56 analysts covering the stock, 42 rate it a “Strong Buy,” five say it is a “Moderate Buy,” and nine rate it a “Hold.” GOOGL stock is trading close to its average target price of $249. However, its high price estimate of $300 suggests the stock has upside potential of 25% over the next 12 months.

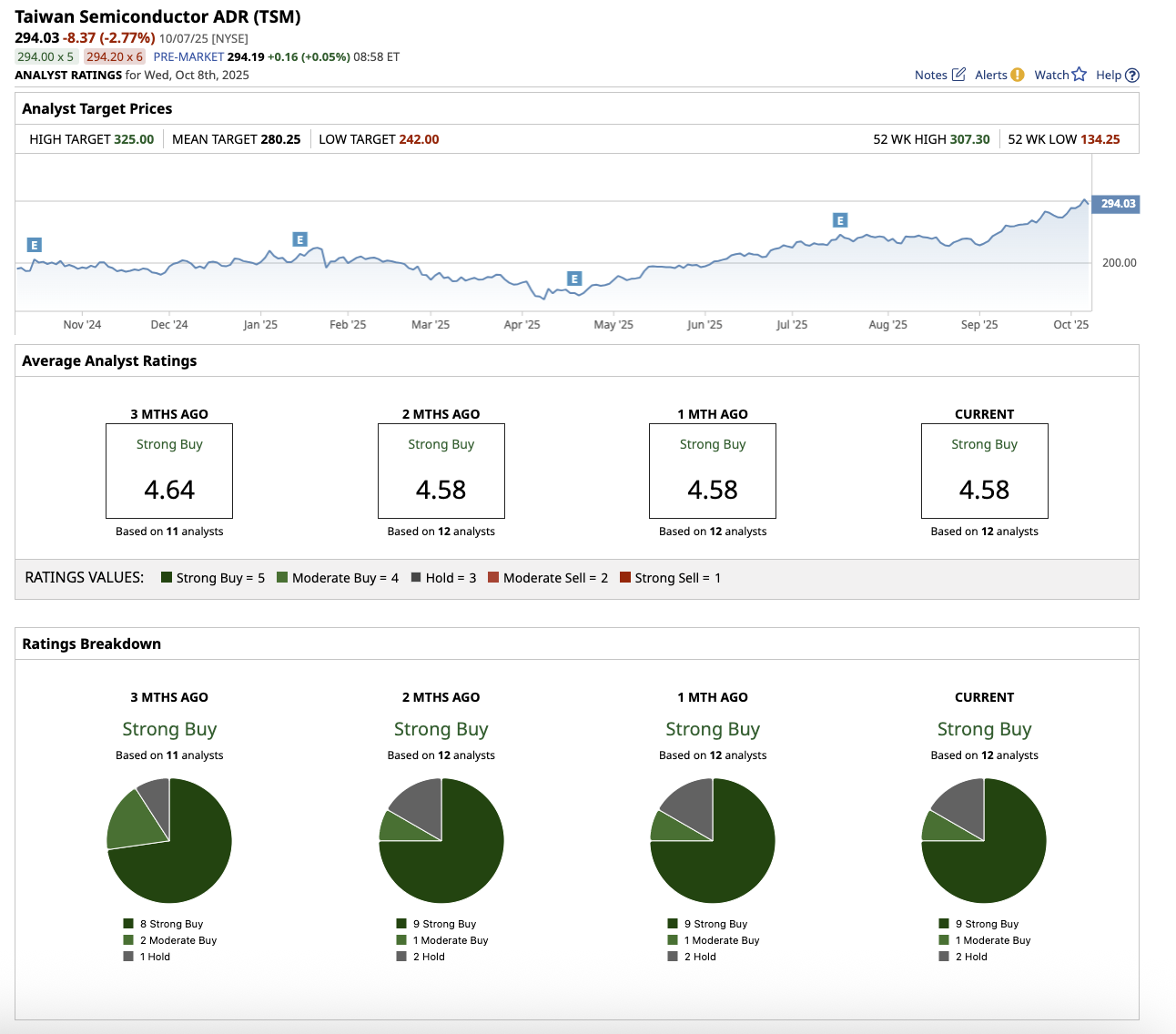

Stock #4: Taiwan Semiconductor Manufacturing Company (TSMC)

Valued at $1.6 billion, Taiwan Semiconductor Manufacturing Company (TSMC) (TSM) is at the center of the AI economy, powering the world’s most advanced chips that make artificial intelligence possible. TSM stock has gained 50.9% year-to-date, outperforming the broader market gain.

As the world’s premier foundry, TSMC produces cutting-edge semiconductors for industry giants such as Nvidia, Apple (AAPL), and Advanced Micro Devices (AMD), companies that are driving the AI boom. The company continued to surpass estimates, with second-quarter revenue increasing 44.4% year over year to $30.1 billion and earnings per share rising 60.7%. Its leadership in advanced chip technology is unparalleled. The company’s $165 billion investment to build six advanced fabs in the U.S., along with expansions in Japan, Europe, and Taiwan, ensures long-term supply stability for global tech leaders.

Overall, Wall Street rates TSM stock a “Strong Buy.” Out of the 12 analysts that cover the stock, nine rate it a “Strong Buy,” one says it is a “Moderate Buy,” and two rate it a “Hold.” TSM stock has exceeded its average target price of $280.25. However, its high price estimate of $325 implies upside potential of 10.5% from current levels.

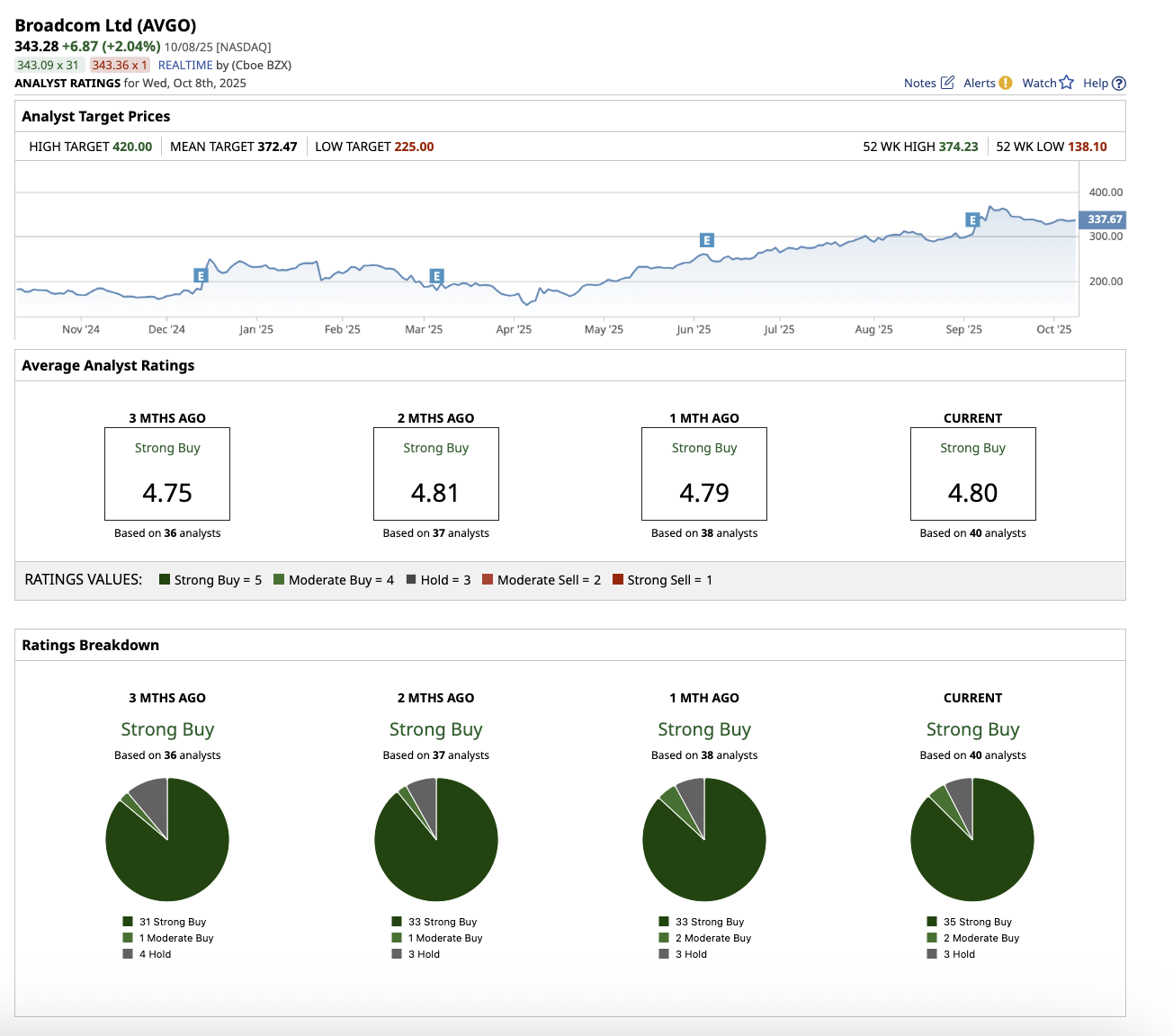

Stock #5: Broadcom

Valued at $1.6 trillion, Broadcom’s (AVGO) semiconductor expertise and expanding software ecosystem following the VMware acquisition are positioning it to dominate the AI economy. Broadcom’s stock has gained 47.8% year-to-date, outperforming the tech-heavy Nasdaq Composite.

In the third quarter of fiscal 2025, the company’s AI chip revenue reached $5.2 billion, up an incredible 63% from last year, marking the tenth consecutive quarter of double-digit AI growth.

The company’s XPU (custom AI chip) division currently accounts for 65% of its AI revenue, with a newly acquired fourth hyperscale customer — believed to be OpenAI — boosting future visibility. A recent $10 billion AI rack order highlights Broadcom’s trust among leading AI players and paves the way for rapid growth in fiscal 2026. With robust margins, consistent dividends, and long-term contracts with the biggest names in tech, Broadcom is poised to dominate the AI economy for the next decade.

Overall, AVGO stock holds a “Strong Buy” rating. Out of the 40 analysts in coverage, 35 rate it a “Strong Buy,” two say it is a “Moderate Buy,” and three recommend a “Hold.” Based on the mean target price of $372.47, the stock has potential upside of 8.5% from current levels. Plus, its high price estimate of $420 indicates the stock could gain as much as 22.4% in the next 12 months.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.